Certified Chartered Accountancy (CA) Specialist

Duration: 50 Hours

A Chartered Accountant (CA) is a financial expert specializing in accounting, auditing, taxation, and financial management. Key responsibilities include preparing and auditing financial statements, designing tax strategies, managing budgets, providing financial advice, and ensuring regulatory compliance. CAs play a crucial role in strategic decision-making, risk management, and business planning to drive organizational success.

Prerequisites

A solid foundation in mathematics, accounting, and economics.

Completion of prerequisite exams such as the Common Proficiency Test (CPT) or its equivalent.

Strong analytical skills, problem-solving abilities, and attention to detail.

What is CA Intermediate?

CA Intermediate is the second level of the Chartered Accountancy course, conducted by the Institute of Chartered Accountants of India (ICAI). It builds on the concepts learned in CA Foundation and prepares students for advanced accounting, auditing, taxation, and corporate laws.

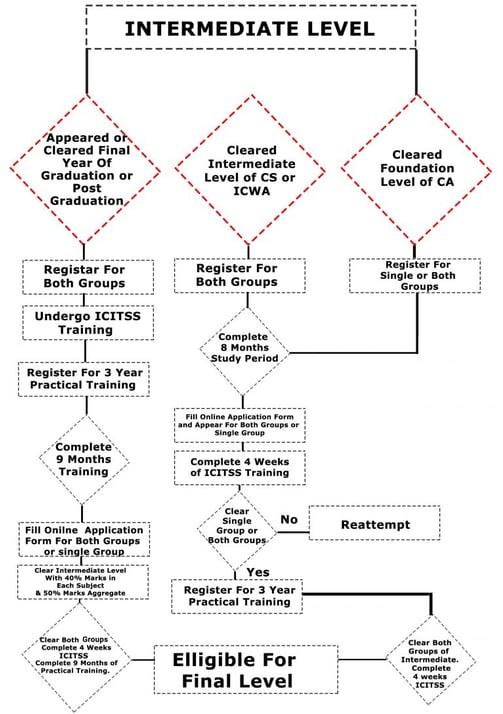

How to Become a Chartered Accountant (CA) – Intermediate Level?

After passing the CA Foundation Exam or through Direct Entry (Graduates/Postgraduates or CS/ICWA Inter qualified candidates), students can enroll in CA Intermediate.

Steps to Become a CA via CA Intermediate Route:

Register for CA Intermediate Course (After CA Foundation or Direct Entry)

Prepare for 8 Months before appearing for the CA Intermediate Exam

Pass CA Intermediate Exam (Minimum 40% in each subject & 50% aggregate)

Register for 3 Years of Articleship (Practical Training) under a practicing CA

Complete Advanced ITT and Management & Communication Skills (MCS) Training

Register for CA Final Course while completing the last 6 months of the Articles

Pass the CA Final Exam and become a Certified Chartered Accountant

Eligibility for CA Intermediate

✔ Through CA Foundation: Must pass CA Foundation before registering

✔ Through Direct Entry: Commerce graduates (55%) / Non-commerce graduates (60%) / CS or ICWA Inter qualified candidates can directly enroll

Why Choose CA Intermediate?

✔ Enhances financial, legal, and auditing expertise

✔ Gateway to practical industry exposure through articleship

✔ Opens career opportunities in taxation, auditing, and consulting